Malaga | Project Casa Fortuna

Urbanización El Herrojo, Benahavís, Málaga, Málaga

1,947,500 €

0 €

0

26-30 months

*NEXT OPENING TUESDAY, JANUARY 20 AT 16:00h*

Click HERE to watch the Webinar "Urbanitae up close - Casa Fortuna Project", where we will tell you all the details of the project

Málaga | Casa Fortuna Project

• Capital gain project in Benahavís

• Project with building license

• Ticket: €1,947,500 // Term: 26 - 30 months

• Financing agreed with land tranche

• Immediate start of works

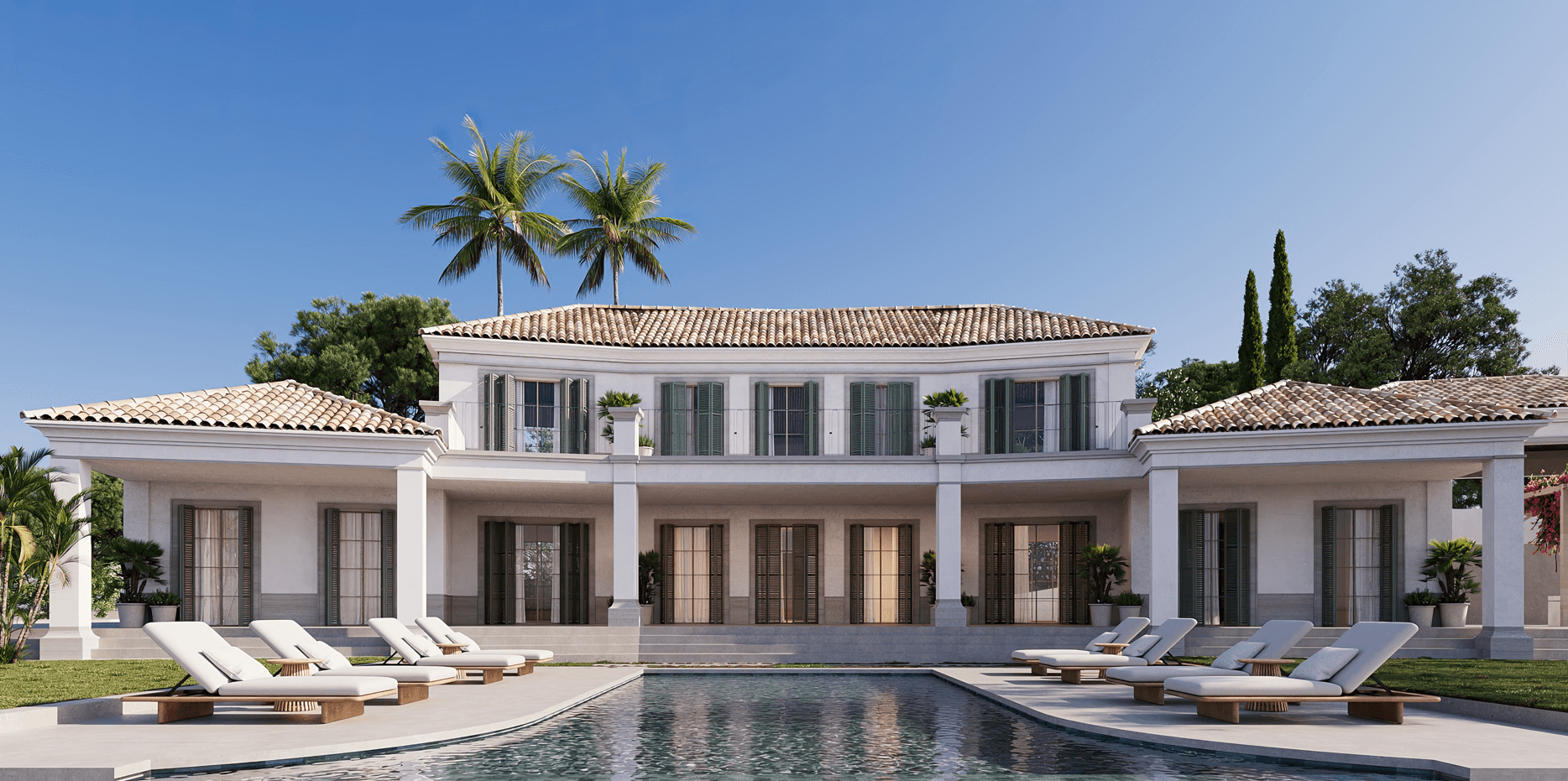

We present a new real estate development project consisting of the acquisition of a luxury home located in the El Herrojo urbanization in the municipality of Benahavís, consisting of its complete reform and development of a six-bedroom house with a pool, gym, spa, and garage with capacity for seven vehicles. The project has the building license granted and the start of works is expected next month. Currently, negotiations are underway with a financial entity for the loan that will cover part of the asset acquisition and construction and development costs.

The Urbanization El Herrojo, located in Benahavís, is an exclusive gated residential development known for its high level of security, privacy, and natural environment. Located in the La Quinta area, very close to Marbella and Puerto Banús, it stands out for its luxury villas, large plots, and panoramic views of the sea, mountains, and golf courses, making it an ideal choice for those seeking tranquility and quality of life on the Costa del Sol.

You must be logged in to see this information

If you are not yet registered, what are you waiting for?

If you already have an account, access here

Location

Urbanización El Herrojo, Benahavís, Málaga,

Málaga, España